Wells Fargo is considered one of the biggest U.S. financial services firms and adopts. A balanced marketing approach that is based on the 4Ps of marketing: Product, Price, Place, and Promotion. The four basic elements keep the bank in touch and at par with competitors in such a fast-changing industry. This has been how Wells Fargo strategically became a leader in not only retail banking but also corporate banking. Its successful use of the 4Ps framework. This paper discusses how Wells Fargo is applying all the 4Ps of marketing to achieve high satisfaction and drive growth for its brand image in the marketplace.

Key Takeaways:

- Wells Fargo utilizes a comprehensive 4Ps marketing strategy: Product, Price, Place, and Promotion, tailored to customer needs.

- The bank offers a diversified range of financial products and services for individual, small business, and corporate clients.

- Pricing strategies include competitive rates, value-added services, and fee-based offerings to cater to different income brackets.

- Wells Fargo’s extensive branch network and online presence ensure accessibility for customers nationwide.

- Promotional efforts include digital marketing, sponsorships, and partnerships to enhance brand awareness and customer engagement.

Product: Diversified Financial Solutions

All-rounded Product Portfolio

Wells Fargo offers numerous financial products for individuals, small and large business undertakings. Among its varieties are checking and saving accounts, loans, mortgages, credit cards, investment services, insurance products, and wealth management services.

Also, Read More: how does wells fargo use the 4ps of marketing

This kind of diversified portfolio by Wells Fargo ensures that it caters to a varied customer segment. Ranging from common day-to-day banking services to complex financial planning for high-net-worth customers. The innovation orientation of the bank helps in be competitive by introducing. The new products aligned with the shifting expectations of customers and technological advancements.

| Product Category | Examples of Offerings |

|---|---|

| Personal Banking | Checking accounts, savings accounts, credit cards, loans |

| Wealth and Investment | Financial advisory, retirement planning, asset management |

| Corporate Banking | Business loans, merchant services, treasury management |

| Insurance | Auto, home, life, and health insurance |

Digital Banking Products

There have also been huge investments in mobile apps and online banking for Wells Fargo, which allows bank customers. The convenience of managing accounts, depositing checks, transferring money, and viewing transactions in real time. Such convenience and satisfaction place Wells Fargo at the top of digital banking. Where business is attracted toward those who are tech-savvy and prefer on-the-go banking.

As of 2023, nearly 77% of Wells Fargo active customers use digital banking services and therefore continue to provide better security features along with user-friendly interfaces.

Price: Competitive and Transparent Pricing Strategy

Competitive Interest Rates and Fees

Competitive rates on various products like saving accounts, loans, and mortgages are included in the pricing strategy. If the customer has choices, competitive rates will attract and retain customers. Fee structures also differ, with some banks offering fee-free checking accounts and others waiving fees for high-value customers.

For instance, a Wells Fargo Everyday Checking account has no monthly charge provided the customer meets a qualification such as minimum balance or direct deposits. Such a pricing system is flexible and thus enables business and wealth customers of all levels of income to be served by different products.

| Product | Pricing Strategy |

|---|---|

| Checking Account | No monthly fee with qualifying direct deposits |

| Mortgage Loans | Competitive interest rates and personalized rate options |

| Investment Services | Fee-based advisory services, commission structures |

| Business Loans | Flexible repayment terms and interest rates |

Customized Pricing to Business and Wealth Customers

The bank provides package pricing deals to business and corporate customers. In serving high-net-worth persons and corporations. The bank employs unique solutions that encompass fee cuts and tailored interest rates associated with the number of accounts and the terms of the banking relationship.

Also, Read More: how does wells fargo use the 4ps of marketing

Segmentation in Wells Fargo

Value and profitability to this bank come through by offering the right price strategy to its various targeted markets.

Place: Wider Reach and Accessibility

Broad Branch and ATM Network

The strength of “Place” of 4Ps is with Wells Fargo in its vast network of branch locations and ATMs. The firm operates over 4,700 branches and more than 12,000 ATMs in the United States by the year 2023. It has been easy to extend banking services to thousands of people residing within the country.

While most banks continue to contract their physical footprint, Wells Fargo expands its geographical footprint through locations that are both urban and rural. The huge geographic footprint means all customers are bound to receive differentiated and personalized services that banks offer across all their branches.

| Bank | Number of Branches (2023) | Number of ATMs |

|---|---|---|

| Wells Fargo | 4,700 | 12,000 |

| Bank of America | 3,900 | 16,000 |

| JPMorgan Chase | 4,800 | 16,000 |

Digital Banking Channels

Besides the physical existence, Wells Fargo provides a strong online and mobile banking system that gives access to customers 24/7. Digital platforms in the bank provide mobile deposits, online bill payments, and money transfers.

During the COVID-19 period, Wells Fargo gained more digital engagement. As of 2022, the company remains with more than 33 million active digital users. This indicates the need to maintain both digital and physical access points for such customers who prefer different ways of doing their banking.

International Services and Partnerships

International banking services: the bank provides international currency exchange, cross-border remittances, and international investment opportunities. By strategic cooperation with the international financial system and institutions, Wells Fargo banks with global business interests, hence its service provisions are meant to satisfy the needs of a more interconnected world.

Promotion: Branding and Marketing Campaigns

Integrated Marketing Campaigns

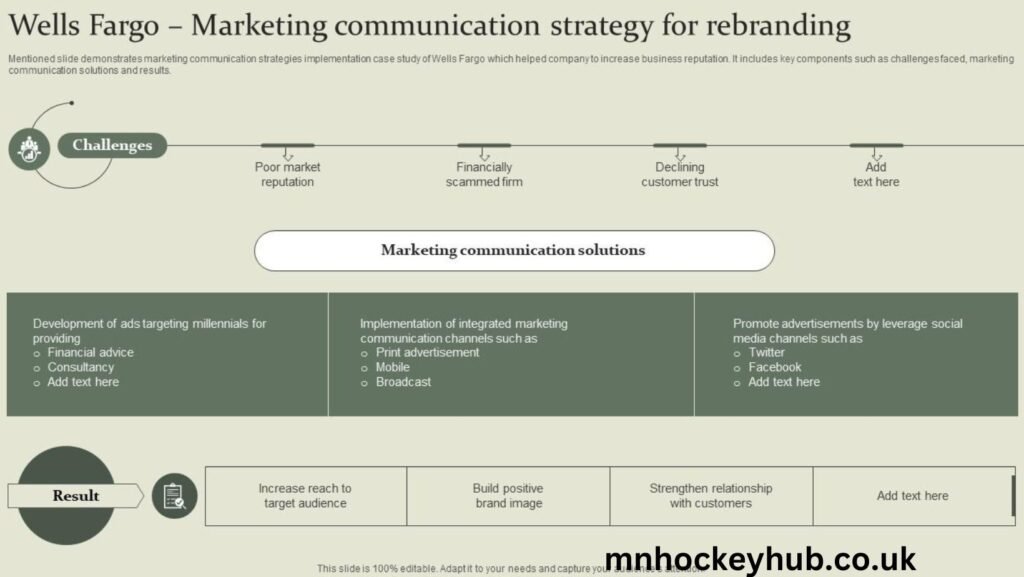

The promotional strategy of Wells Fargo is based on generating consistent brand messages across diverse channels, including traditional media, digital advertising, social media, and even direct customer outreach programs. Branding focuses on trust, reliability, and long-term relationships, which fit well with the legacy status of a financial institution.

One of Wells Fargo’s most prominent campaigns, “Together We’ll Go Far,” emphasizes community values and the bank’s commitment to helping customers achieve their financial goals. The campaign has been instrumental in shaping the public’s perception of Wells Fargo as a supportive and customer-focused institution.

| Campaign | Message | Impact |

|---|---|---|

| “Together We’ll Go Far” | Emphasizes customer support and financial success | Boosts brand trust and customer loyalty |

| Financial Education Programs | Promotes financial literacy and smart money habits | Engages customers with value-added resources |

Digital and Social Media Marketing

Wells Fargo will use online marketing for more significant users whom, perhaps may be youth with a preference for online banking. The bank shall undertake targeted adverts on various sites like Facebook, Instagram, and LinkedIn, focusing on the major products; for instance, credit cards, loans, and even wealth management services. It also enhances personalization as the messages passed to consumers become relevant because of behavioral influence among customers, increasing the rates of turnaround and conversion.

Also, Read More: how does wells fargo use the 4ps of marketing

On the other hand, the social media presence of the bank encourages interactive communication from both the bank and its customers. Through serving customer questions and sharing informative content, Wells Fargo enhances its relationship with current clients while also drawing new ones.

| Channel | Strategy |

|---|---|

| Targeted ads, customer engagement | |

| Visual content, product promotion | |

| Professional networking, corporate services |

FAQs

How does Wells Fargo apply the 4Ps of marketing?

Wells Fargo adopts the 4Ps of marketing with diverse financial products (Product), competitive pricing strategy, having a large place reach through local branches and online channels, and promotional brand with integrated marketing activities.

What is the promotion strategy of Wells Fargo?

The promotion strategy adopted by Wells Fargo consists of integrated campaigns with more stress on trust in the relations with customers and with precisely targeted digital marketing and social media activity.

How does Wells Fargo determine its prices?

Wells Fargo determines its prices based on competitive interest rates, customized fee structures, and value-added services customized for different customer segments.

How does Wells Fargo provide access to customers?

Wells Fargo provides access to customers by having a vast number of branches, ATMs, and digital platforms that make it possible for customers to access bank services through several channels.

What does Wells Fargo sell?

Wells Fargo is an institution that offers a diversified portfolio of products, such as personal banking, investment services, loans, mortgages, credit cards, and insurance products designed for individual customers, businesses, or corporations.

Also, Read More: how does wells fargo use the 4ps of marketing

Conclusion

Wells Fargo utilizes a marketing strategy that generally revolves around the 4Ps to be successful in the financial industry. The company, Wells Fargo, had prospered in the very competitive market through some means that included offering a vast range of products. Keeping competitive prices in place, making the accessibility of both its physical and online channels. Promoting its brand through an integrated campaign. Its flexibility while continuing to ensure that it delivers sound. Trustable brand values makes the firm stand out from so many businesses competing in the financial services sphere.